Cash.co.uk’s value of residing statistics revealed that at a retirement age of 65+, a median pension of £19,000 is required to reside alone within the UK. However with spending tightening throughout the nation, are workers in sure industries dealing with better cuts to their pension contributions than others?

The financial savings consultants at cash.co.uk checked out the newest Workplace for Nationwide Statistics pensions contribution figures to disclose how pension contributions have modified in every trade throughout the UK over the previous years. And from this, the estimated future tendencies within the subsequent 5 years.

Employer pension contributions over the past 5 years

Solely three out of 16 industries noticed a rise in employer pension contributions on the finish of a five-year interval from 2017 to the most recent ONS figures from 2021.

Public Administration, together with the Schooling sector, had the very best employer pension contributions at 15-20% in 2017. Whereas Schooling trade contributions stay the identical, Public Administration contributions have risen to above 20%, the very best amongst all industries analysed.

Monetary and insurance coverage sector employer pension contributions elevated from 8-10% to 10-12% between 2017 to 2021 and stay on the similar stage now. For the actual property trade and transportation trade, it fluctuated over time however at present stays in the identical 8-10% bracket.

The administration sector had the bottom employer pension contribution, at lower than 4% in 2017 and 2018. This elevated to 8-10% in 2019 and stays regular.

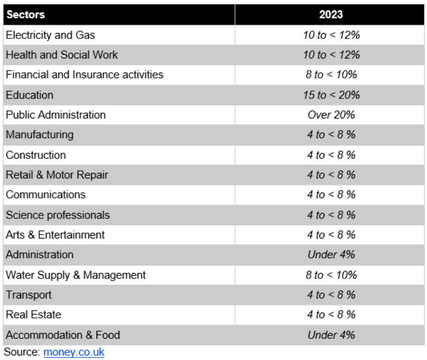

Desk 1: UK pension contributions by trade in 2023

Public administration is the one sector with an anticipated improve in employer contributions over the subsequent 5 years

At the moment, the general public administration trade has the very best employer pension contributions at 20% and above, adopted by training at 15-20%. Behind are well being and social work and electrical energy and fuel at 10-12%. Out of those industries, training is the one one that can see a rise in pension contributions, rising from the already above-average 15-20% to greater than 20% by 2028.

5 industries are set to see a discount in pension contributions this 2023

Cash.co.uk predicts that six out of 16 industries will see a lower in employer pension contributions within the subsequent 5 years, with 5 industries already experiencing a lower in 2023. Solely retail and motor restore can have extra time to arrange for a discount in pension contributions, which is predicted to occur in 2026, whereas workers within the building trade can anticipate it as early as 2023.

Monetary and insurance coverage actions at present obtain a pension contribution of 10-12% however will see their retirement funds cut back to 8-10% already this yr, a quantity that it’s more likely to stay the identical till 2028.

Transportation, actual property, and water provide and administration have their retirement funds at a bracket of 8-10%. The transportation and actual property sectors are predicted to have it decreased to a bracket of 4-10% already in 2023 till the subsequent 5 years.

At a present vary of 4-8%, the development, retail and motor restore, and administration industries are anticipated to fall to under 4% and revert near the three% minimal in pension contributions by 2028. Moreover, retirement funds for the lodging and meals service trade can also be anticipated to stay at lower than 4% by 2028. The sector has not seen a rise in employer pension contributions since 2014.

Lucinda O’Brien, private finance professional at cash.co.uk, supplies steerage on saving for retirement:

“With inflation at an all-time excessive in 40 years it has created a fluctuating financial atmosphere, in order that each workers and employers are impacted. If financial savings should not made exterior of pension contributions, it might probably negatively have an effect on retirement financial savings additional down the road.

- “Finances weekly, month-to-month, and yearly – To correctly plan to your monetary well being, saving to your future have to be taken under consideration alongside rapid short-term spending. Create a price range plan for every week, month, and yr to make sure that you’re appropriately planning to your future. Goal to satisfy saving targets for annually to make sure that you’re contributing to your pensions in your private financial savings too.

- “Construct an funding portfolio – Diversifying your financial savings is an effective way to generate returns on it which are better than what is obtainable by your financial institution’s financial savings rate of interest. Nevertheless, all the time do your analysis as investing carries some danger.

- “Utilise a Lifetime ISA – Greatest used for purchasing a property or saving for later life, those that are between the ages of 18 and 40 ought to open a LISA account. It lets you save as much as £4,000 annually with the federal government contributing a further 25% to your financial savings (£1,000 max).

- “Switch your debt to pay much less curiosity – If you’re carrying bank card debt that you recognize you can’t repay with one cost, think about stability switch bank cards. This lets you debt from one card (or a number of playing cards) to a different card from a distinct supplier. The goal is to change to a bank card that provides a decrease rate of interest or no curiosity for a set time which can mean you can make repayments with out accruing extra debt within the meantime.

- “Set a financial savings purpose” – Setting a financial savings purpose begins with figuring out how a lot spare earnings you possibly can put in the direction of your goal every month. For brief time period objectives like holidays or dwelling home equipment, a financial savings pot inside your financial institution can be one of the simplest ways to put aside cash. For long run objectives like your retirement fund or deposit for a home, a lifetime ISA lets you save as much as £4,000 a yr tax free with a authorities contribution.”